Property Tax

What is Property Tax?

Property taxes are taxes that are assessed, collected, and used locally. You pay your property taxes to the local tax collector, who then distributes funds to the entities that have jurisdiction over your property (schools, cities, and other local governments). These entities spend the collected funds on schools, roads, hospitals, police departments, fire departments, and other programs.

Who is responsible for setting Property Taxes?

The Appraisal District appraises the value of your property each year. Any disputes with an appraisal that cannot be agreed upon between the property owner and the Appraisal District are settled by the Appraisal Review Board. Once these values are certified, the Appraisal District provides that information to the local taxing units. These entities use that data to set their budgets and the property tax rates. The County Assessor/Collector collects the taxes from the property owners and distributes the funds to the local taxing units.

What are my rights under the Texas Constitution?

The Texas Constitution sets out five basic rules for property taxes in our state:

- Taxation must be equal and uniform. No single property or type of property should pay more than its fair share. The property taxes you pay are based on the value of property you own. If, for instance, your property is worth half as much as the property owned by your neighbor (after any exemptions that apply), your tax bill should be one-half of your neighbor’s. This means that uniform appraisal is very important.

- Generally, all property must be taxed based on its current market value. That’s the price it would sell for when both buyer and seller seek the best price and neither is under pressure to buy or sell. The Texas Constitution provides certain exceptions to this rule, such as the use of “productivity values” for agricultural and timberland. This means that the land is taxed based on the value of what it produces, such as crops and livestock, rather than its sale value. This lowers the tax bill for such land.

- Each property in a county must have a single appraised value. This means that the various local governments to which you pay property taxes cannot assign different values to your property; all must use the same value. This is guaranteed by the use of county appraisal districts.

- All property is taxable unless federal or state law exempts it from the tax. These exemptions may exclude all or part of your property’s value from taxation.

- Property owners have a right to reasonable notice of increases in their appraised property value.

More information on the Texas Property Tax Code can be found here.

What are my remedies?

If you believe that your property value determination is too high or if you were denied an exemption or special appraisal valuation, please contact the Appraisal District immediately. If you are unable to come to an agreement with the Appraisal District you may file a protest regarding the property to the Appraisal Review Board (ARB) within the deadline that is provided on your appraisal notice. If you do not agree with the decision of the ARB you may appeal the decision in district court. Alternatively, you may appeal the ARB’s determination to binding arbitration.

Regarding how your tax dollars are spent, you have the option to attend and speak at the local hearings where the elected officials both set tax rates and decide how tax revenue is used. Major tax rate increases and roll backs are limited through the use of special elections.

When is the deadline for paying my property taxes?

Taxes are due when you receive your tax statement. Tax collections begin around October 1 and taxpayers have until January 31 of the following year to pay their taxes. On February 1 penalty and interest charges begin accumulating on most unpaid tax bills.

What happens if I don’t pay my taxes?

The longer you allow delinquent property taxes to go unpaid, the more penalties and interest will stack up. If your property boundaries span more than one county you will receive appraisal notices from each county appraisal district. If unpaid, penalties and interest will accrue in both districts.

Exemptions/Ownership

What exemptions are available?

There are several partial and absolute exemptions available. Some of these exemptions include general Residential Homestead, Over 65, Surviving Spouse (age 55 and over), Disability Homestead, Disabled Veterans, Charitable, Religious, Freeport and Pollution Control.

Does my home qualify for an exemption?

As a general rule to qualify for an exemption you must own your home and it must be your principal place of residence. Additional qualifications may apply based on the exemption.

Will this protect me in case of a lawsuit for unpaid taxes?

Texas has two distinct laws for designating a homestead. The Texas Tax Code offers homeowners a way to apply for homestead exemptions to reduce local property taxes. The Texas Property Code allows homeowners to designate their homesteads to protect them from a forced sale to satisfy creditors. This law does not, however, protect the homeowner from tax foreclosure sales of their homes for delinquent taxes. For more information on homestead designation as provided by the Texas Property Code please contact the Office of Attorney General.

How much will I save?

An exemption removes part of the value of your property from taxation and lowers your tax bill. In addition to the state mandated exemption amounts for school taxes, each taxing unit decides whether to offer the optional exemption and at what percentage. The amount of savings depends on the exemption and the amount of exemption allowed by each taxing units.

Do I apply for a homestead exemption annually?

Only a one-time application is required unless the Chief Appraiser requests the property owner to file a new application by written notice. A new application is required when a property owner’s residence homestead is changed.

I own more than one home, can I get a homestead on both?

A person may not receive a homestead exemption for more than residence homestead in the same year. You can receive a homestead exemption only for your main or principal residence.

What if I owned the property before I was married?

You can still only have one exemption which must be claimed on your principal residence.

I own my own homestead, but also own a home with my child that they live in, would they qualify for a homestead?

They must have ownership interest in the property to qualify and would only receive a portion of the exemption based on the percent of ownership.

My exemption fell off from last year, why?

Exemptions reflect the January 1 owner. If you purchased a home after January 1st the exemption in place was for the previous owner. You must file an exemption application.

I forgot to apply for my exemption, can I receive it retroactively?

You may file a late homestead exemption application if you file it no later than two year after the date the taxes become delinquent.

Is it true that once I become 65 years of age, I will not have to pay any more taxes?

No, that is not necessarily true. If you are 65 or older your residence homestead qualifies for more exemptions which will result in greater tax savings. The amount of the exemptions that are granted by each taxing unit is subtracted from the market value of your residence and the taxes are calculated on that “lower value”. In addition, when you turn 65, you may receive a tax ceiling for your total school taxes; that is, the school taxes on you residence cannot increase as long as you own and live in that home. The ceiling is set at the amount you pay in the year that you qualify for the aged 65 or older exemption. The school taxes on your home subsequently may fall below the ceiling. If you significantly improve your home (other than ordinary repairs and maintenance), tax ceilings can go up. For example, if you add a room or garage to your home, your tax ceiling can rise. It will also change if you move to a new home.

When do you apply if you are turning 65?

You may apply at any time during the year of your 65th birth date. You would receive the exemption for the full year.

Do I need to file an application when I turn 65 or is it automatically added?

The appraisal district can only automatically process the over 65 exemption if it has the appropriate documentation on hand. Your local appraisal district will require proof of age to grant an over 65 exemption. Acceptable proof of age includes either a copy of the front side of your driver’s license or a copy of a state issued personal identification card. It is always best to file an exemption application with the appropriate documents to ensure that the Over 65 exemption is processed.

If I am the surviving spouse of a person age 65 or older, am I entitled to the school tax ceiling?

Yes, surviving spouses (55 years of age or older) of persons who were 65 years of age or older when they died will benefit from the tax ceiling.

If I am the surviving spouse of a disabled person, am I entitled to the school tax ceiling?

Yes, surviving spouses (55 years of age or older) of a spouse with disability when passed away will benefit from the tax ceiling.

If I am 65 years of age or older, disabled or a surviving spouse who is age 55 or older, does a tax ceiling apply to county, city or junior college district property taxes?

Yes, if the county commissioners court, city council or board of the junior college district authorizes a tax limitation on the homesteads of persons 65 years of age or older or disabled. The taxing unit’s governing bodies or voters (by petition and election) may adopt the limitation. This local option exemption does not apply to other special districts such as water, hospital, etc.

If I am disabled and over 65 can I claim both exemptions in the same tax year?

You may claim both an Over 65 and a disabled person’s exemption in the same tax year but you may not claim them both on the same taxing entity. (as of 1/1/2020)

I have a disabled child. Would that qualify me for a disabled exemption?

No, the person applying for the exemption must own the home

What types of exemptions require an annual application?

The law requires an annual application by April 30 for some types of exemptions, including property exempted from Taxation by Agreement (Property Tax Abatement), Historical and Archeological Sites, and exemption of Freeport Goods. Pollution Control property approved by the Texas Commission on Environment Quality (TCEQ), Cemeteries, charitable organizations, youth development organizations, religious organizations, and non-profit private schools do not have to reapply for the exemption each year once the property tax exemption is granted, unless by written notice, the Chief Appraiser requests the property owner to file a new application. However, if their exempt property changes ownership or if their qualifications for exemption change, they must reapply.

Must I notify the Appraisal District if my entitlement to an exemption ends?

Yes, a person who receives an exemption that is not required to be claimed annually must notify the Appraisal District in writing before May 1 after the entitlement to the exemption ends.

Does a non-profit organization automatically receive a property tax exemption?

No. Often organizations mistakenly believe they are entitled to a property tax exemption because they have received a federal income tax exemption under Section 501(c) (3) of the Internal Revenue Code or an exemption from State sales taxes. The constitution requirements for property tax exemptions are different than the provisions covering income and sales taxes. A non-profit organization may qualify for a total exemption from property taxes.

How can I change my mailing address?

A request indicating an address correct must be made in writing and a daytime phone number where you can be reached, in case we have questions.

What do I do if the ownership does not reflect the current ownership of a property?

After 90 days from the date of closing on a property, if the appraisal record does not reflect the current ownership, please contact the Property Records Department at (903) 238-8823.

Property Values

How do I find out the appraised value of my property?

The chief appraiser sends out a detailed notice of appraised value to the owner of property annually. The notice of appraised value contains a description of your property, its value, the exemptions and an estimate of taxes that might be owed. Property value information is also available on the website Property Search, or by calling or visiting our offices.

When do you mail Notices of Appraised Value?

The current year notices of appraised value are typically mailed out mid April of each year. Values on the website for the current tax year are subject to change until the notices have been mailed.

How is my property valued?

First, the district collects detailed descriptions of each taxable property within its jurisdiction. It then classifies properties according to a variety of factors such as size, use, and construction type. Using comparable sales, income, and/or cost data, an appraiser will apply generally accepted appraisal techniques to derive a value for your property.

How often does the appraisal district value my property?

The appraisal district must repeat the appraisal process for each property in the county at least once every three years; however, Gregg County Appraisal District reappraises properties in its jurisdiction every year.

Why did my value change?

Value changes may occur for several reasons. Often sales information may indicate the current appraised value is lower/higher than fair market. Also, corrections to appraisal records may affect value, such as, change in square footage, a pool not previously accounted for, or a correction of a property characteristic.

Why are you inspecting my property?

In order to make accurate appraisals on every property we have to visit them periodically to ensure that the data used in making the appraisal is still correct. For instance, the Appraisal District could have received a copy of a building permit indicating that a room was being added.

What is an improvement?

An improvement is a building, structure, or fixture erected on or affixed to land. It can also refer to a transportable structure that is designed to be occupied for residential or business purposes.

What is fair market value?

Fair market value is the price at which a property would transfer for cash or its equivalent under prevailing market conditions if:

- it is exposed for sale in the open market with a reasonable time for the seller to find a purchaser;

- both the seller and the purchaser know of all the uses and purposes to which the property is adapted and for which it is capable of being used and of the enforceable restrictions on its use; and

- both the seller and purchaser seek to maximize their gains and neither is in a position to take advantage of the exigencies of the other.

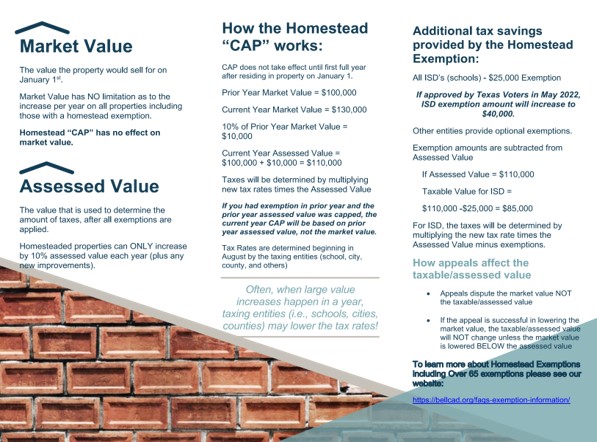

What is a Homestead Cap?

An additional benefit of the general homestead exemption, especially in an appreciating housing market, is the homestead cap, or limitation on increases in appraised value. The cap applies to your homestead beginning in the second year you have a homestead exemption. The cap law provides that if you qualify, the value on which your taxes will be calculated (called your appraised value) cannot exceed the lesser of:

- This year’s market value; or

- Last year’s appraised value, plus 10% plus the value added by any new improvements made during the preceding year.

If homes are appreciating at more than 10% per year, the cap can provide substantial tax savings.

Texas Property Tax Code Sec 23.23 limits increases of the total assessed value (assessed value = market value minus any exemption value minus current year cap value), to 10% from year to year if the property is under homestead exemption.

This 10% increase excludes any new improvements added by the property owner. This section does not limit market value increases. Market value is what a property would sell for and can change from year to year based on sales data. The assessed value is used to calculate taxes. Please note that this limitation takes effect on January 1 of the tax year following the first year the owner qualifies the property for a homestead exemption. The assessed value may increase at a rate of up to 10% per year until it matches the district’s appraised market value.

Example:

For more information please visit: The Comptroller’s Property Tax Assistance website.

PROTESTING VALUE

How do I protest my value?

To protest an appraised value set by GCAD, a taxpayer must notify the Appraisal District in writing by May 15 or 30 days from the date of the notice, whichever is later. If the Appraisal District generated no Notice of Appraised Value a protest may still be filed. The Notice of Protest need not be an official form; however, the Appraisal District can send you a Notice of Protest form to complete and submit. You can submit a signed letter stating the protesting property owner’s name, identifying the subject property and indicating an apparent dissatisfaction with some determination of the Appraisal District.

If I protest, how will I be notified of my hearing?

You will receive a Notice to Appear before the Appraisal Review Board (ARB) at least 15 days prior to your hearing. The notice will also contain a date and time that you can discuss the appraised value of your home informally with an appraiser. If you and the appraiser agree on the value of your home you will not have to appear before the ARB. If you do not agree with the appraiser you will be required to appear at your scheduled hearing and present your case to the Appraisal Review Board.

If I protest, how should I prepare for my hearing?

You should gather evidence which supports your view of the value of your home. This would include sales of comparable homes in your neighborhood, the purchase price of your home, photographs of your home and comparable homes, or photographs of details of your home showing conditions such as cracks, flood damage, and so forth. Your presentation should be direct, concise and honest. Stick to the facts and avoid discussing issues that do not have anything to do with the value of your property such as the tax rate and percent increase from one year to the next. The panel hearing your case will inform you of the value set for taxation on your home. You will also receive, by certified mail, a written order from the Appraisal Review Board showing the value set on your property.

What is the Appraisal Review Board?

The Appraisal Review Board or ARB is a group of private citizens authorized by state law to resolve protest disputes between taxpayers and the Appraisal District. An ARB is established for each Appraisal District in the State of Texas.

Can anyone attend an ARB hearing?

Yes. They are open to the public and a schedule is posted at GCAD.

Business Personal Property

What is Business Personal Property Tax?

Business Personal Property tax is an ad valorem tax on the tangible personal property that is used for the production of income. The State of Texas has jurisdiction to tax personal property if the property is:

- Located in the state for longer than a temporary period.

- Temporarily located outside the state and the owner resides in this state.

- Used continually, whether regularly or irregularly in the state.

(Note: Property is considered to be used continually, whether regularly or irregularly, in this state if the property is used in this state three or more times on regular routes or for three or more completed assignments occurring in close succession throughout the year.)

What is a rendition for Business Personal Property?

A rendition is a form that provides information about property that you own. The Appraisal District uses the information you provide to appraise your property for taxation.

If you own a business, you are required by law to report to your county Appraisal District all personal property that is used in that business. There are substantial penalties for failure to report or for falsification and tax evasion. The Gregg County Appraisal District has prepared this document to assist you in complying with this very important law.

Who must file a rendition?

Renditions must be filed by:

- Owners of tangible personal property that is used for business purposes.

- Owners of tangible personal property on which an exemption has been cancelled or denied.

What types of property must be rendered?

For taxation purposes, there are two basic types of property: real property (land, buildings, and other items attached to land) and personal property (property that can be owned and is not permanently attached to the land or building such as inventory, furniture, fixtures, equipment and machinery). Business owners are required by State law to render personal property that is used in a business or used to produce income. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process. You are not required to render intangible personal property (property that can be owned but does not have a physical form) such as cash, accounts receivable, goodwill, application computer software, and other similar items. If your organization has previously qualified for an exemption that applies to personal property, for example, a religious or charitable organization exemption, you are not required to render the exempt property.

Is my information confidential?

Yes, Information contained in a rendition cannot be disclosed to third parties except in very limited circumstances. In addition, the Texas Property Tax Code specifically provides that any estimate of value you provide is not admissible in proceedings other than a protest to the Appraisal review Board (ARB) or court proceedings related to penalties for failure to render. The final value we place on your property is public information, but the rendered property list as well as the rendition form itself is not.

What happens if I do not file a rendition, or file it late?

If you do not file a rendition, the appraised value of your property will be based on an appraiser’s estimate using comparable business types. In addition, if you fail to file your rendition before the deadline or you do not file it at all, a penalty equal to 10% of the amount of taxes ultimately imposed on the property will be levied against you. There is also a 50% penalty if a court finds you engaged in fraud or other actions with the intent to evade taxes.

If I cannot file the rendition on time, what should I do?

The law provides for an extension of time to file a rendition. In order to receive the extension, you must submit the request to the Gregg County Appraisal District in writing before the April 15 rendition filing deadline. With the receipt of a timely extension request, the rendition filing deadline will be extended to May 15.

What do I do if the Chief Appraiser requests an explanatory statement from me?

If you provide a good faith estimate of market value instead of original cost and acquisition date for any items, the Chief Appraiser may request an explanatory statement from you. The Chief Appraiser must make the request in writing, and you must provide the statement within 20 days of the date you receive the request. The explanatory statement must set out a detailed explanation of the basis for the estimate(s) of market value given in your rendition. The statement must include adequate information to identify the property. If must describe the physical and economic characteristics of the property that are relevant to its market value. It must also give the source (s) of information used in valuing the property and explain the basis for the value estimate.

What if the Appraisal District values my property at a higher amount than what I render?

You will receive a Notice of Appraised Value in late May or early June. If you disagree with the value placed on your property by the Appraisal District, please contact the Gregg Appraisal District immediately. You may also wish to file a protest with the Appraisal Review Board. The protest must be filed by the deadline date indicated on the Notice. Once a timely protest is received, you will be scheduled for a hearing before the Appraisal Review Board. At your Appraisal Review Board hearing, you will be asked to provide documentation for the basis of your opinion of value.

More Questions?

If you have any further questions, please feel free to contact the Gregg Appraisal District Business Personal Property Department and they will be able to help you in anyway they can. You may also look at the documents below that go a bit more in depth into different aspects of business personal property appraisal.